Here’s a simple breakdown of how the NCMS for trading members works:

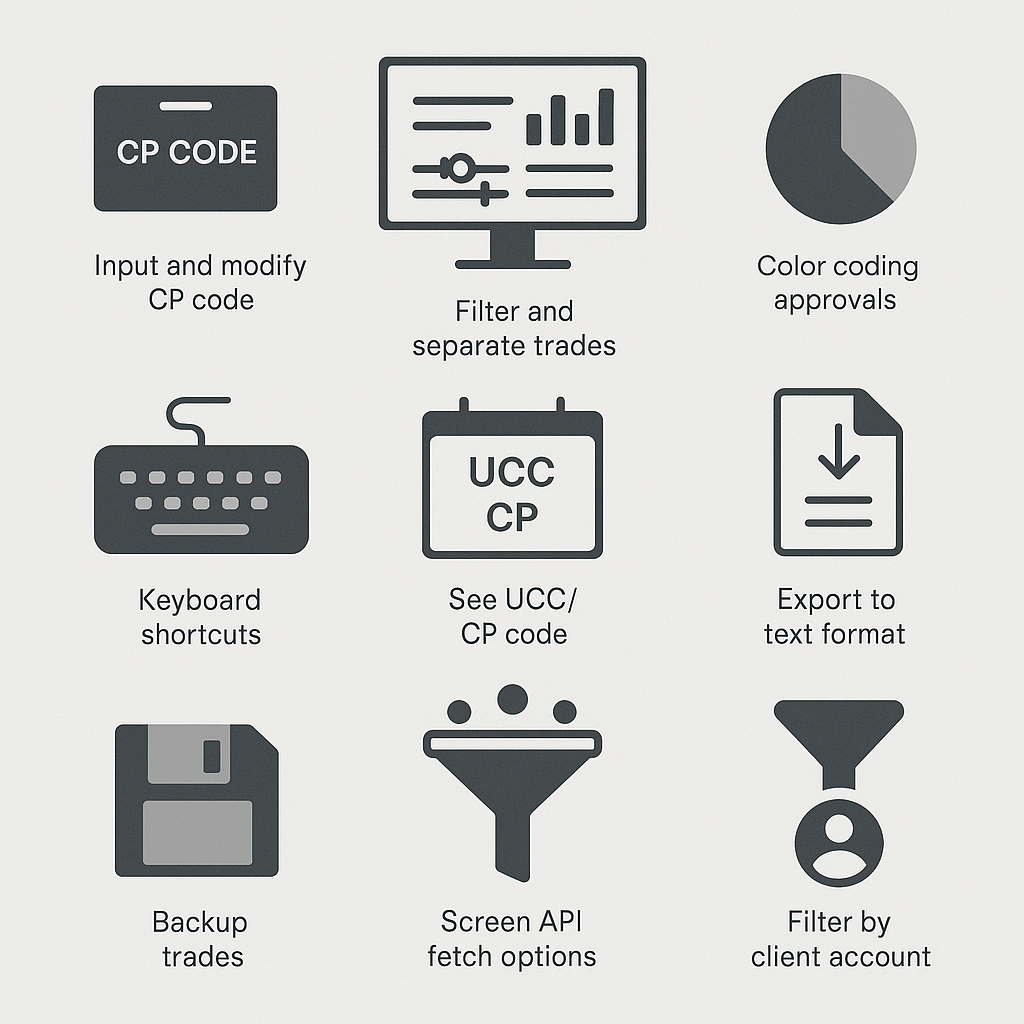

- When placing an order in the NCMS system, members need to input a custodial participant code (CP code).

- Members can change the CP code for their orders during market hours and until 4:15 p.m. after market hours. This can be done by uploading a CP code modification file in the specified format or directly through the NCMS interface. If a file is uploaded, then the system will show whether the records were successful or rejected along with the rejection code.

- Although the current system allows a single user to log in from multiple locations, our NCMS system is designed to work independently, allowing logins from multiple machines only if the exchange allows it.

- The interface includes options to filter data on the screen, and separate screens are available to view confirmed, modified, rejected, and approved trades.

- There will be color coding to indicate the status of approvals and rejections.

- The minimum time between requests for new data is currently set to 15 seconds. If the exchange changes this limit, users will be able to adjust their request times accordingly.

- If brokers want to view the Client Code (UCC) alongside the Custodian Code, they may need to upload specific files to the server. Brokers can upload a master file for this purpose.

- The new NCMS application includes validations that weren’t present before, such as preventing the selection of all trades in a single order.

- The system will allow for quicker modifications and updates compared to the previous application.

-

There are shortcut keys available for quickly viewing reports and uploading data.

-

In the modification window, you can only select from your existing CP, reducing the chances of errors.

-

You can see the UCC Code/Client Code along with the CP Code across all windows.

-

Both trade and action data can be accessed easily.

-

You can export most of the data in a text format.

-

Each report screen will display data with background colors indicating approval, rejection, or modification status.

-

There’s an option to backup all unique trades.

-

Users can set API fetch filtration options to view all trades, CP trades, or TM trades.

-

Application data can be filtered based on the CP Code and Client Account for better organization.