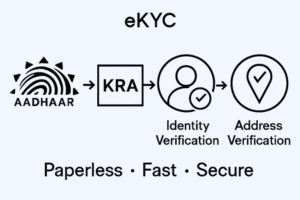

eKYC is a paperless way to verify a customer’s identity and address through Aadhaar and KRA. It replaces the old, traditional KYC process that involves physical copies of ID and address proof.

Key Features of the Proposed Solution:

- A registration screen where users enter their mobile number and email. This acts as the login key and can be used for follow-up if the user doesn’t complete all details.

- OTP verification is sent to the client’s mobile number as well as email address.

- PAN validation and verification through NSDL or other APIs provided by the organization.

- Automatic retrieval of KYC details from CVL KRA or other KRA agencies. Data fetched cannot be edited.

- e-KYC document (Client Registration Form) signed using Aadhaar via NSDL or other providers’ API

- Manual entry options for non-KRA and DigiLocker leads

- Manual entry options for existing details like DP ID, BO ID, bank details (IFSC, account number), etc.

- Option to upload scanned images of documents like PAN card, address proof, bank proof, etc.

-

PDF generation for entered data

-

IPV (In-Person Verification) included as a feature.

-

Live photo capture with geo-tagging

-

DigiLocker integration

-

Penny drop verification via API

-

Integration with back-office systems

-

API-based support for KRA, UCC (NSE and BSE), NSDL DP, CDSL DP, and CKYC files

Key Features of the eKYC by XtremSoft:

- Delivery within 4-5 weeks.

- Responsive design for desktop, tablets, and phones.

- Images saved on both physical media and in the database.

- MIS reports showing the number of leads generated, and how many completed the full form, and many more.